By Mark Bischoff

Commercial

Specialty Trade Contractors Must Observe and Respond to CRE Finance Trends

Image provided by Mark Bischoff.

The 2008 crisis changed everything. Banks stepped back, private credit filled gaps, and fractional ownership platforms let anyone invest in commercial real estate with $500. For specialty contractors, this means more diverse projects, tighter schedules, and new opportunities—if you know where to look.

“The purpose of a business is to create a customer who creates customers.”

— Shiv Singh, SVP, Global Head of Digital and Marketing Transformation - Visa

Bank-Dominated CRE Financing

Prior to 2008, banks were the primary source of real estate financing, providing loans for commercial and residential projects with relatively standardized terms. This era saw high leverage, lax underwriting, and significant exposure to real estate risk, contributing to the 2008 financial crisis. Regulatory reforms, such as Dodd-Frank and Basel III, tightened bank lending standards, reducing risk appetite for real estate loans, especially for speculative or non-core projects. Banks focused on safer, prime assets, leaving gaps in financing for riskier ventures.

This change led to diversified capital sources supporting today’s real estate financing landscape. This environment is more varied, with non-bank players filling gaps left by cautious banks. Alternative lenders offer flexible terms at higher costs. The new players are introducing AI, blockchain, and data analytics to streamline underwriting, risk assessment, and transaction processes, reducing reliance on traditional bank intermediaries. Private credit, private equity, and institutional investors now play outsized roles, driven by demand for yield in a low-rate environment from 2010 to 2022, and the retreat of banks from certain sectors.

Impact of REITs, Private Credit, Private Equity, and Sovereign Wealth Funds

Real Estate Investment Trusts (REITs) have democratized access to real estate by allowing investors to buy shares in diversified portfolios of income-producing properties such as offices, retail, student housing and apartments. Public REITs, traded on exchanges, offer liquidity unavailable in direct real estate. REITs remain a key financing vehicle, raising capital through IPOs and secondary offerings, but face competition from private funds in certain sectors.

Private credit has surged as banks scaled back from riskier real estate loans post-2008. Debt funds, mortgage REITs, and other non-bank lenders filled the gap, offering mezzanine loans, bridge financing, and high-yield debt for projects banks avoid such as value-add or distressed assets. These players have enabled developers to bypass bank restrictions, but increased borrower risk due to higher rates and shorter terms. In recent years, private credit has been critical for refinancing maturing loans amid tight bank lending, though defaults have risen in overleveraged projects. Private credit’s role is expected to grow as banks remain cautious, but defaults may temper enthusiasm for riskier deals.

Private equity real estate funds have transformed the market by pooling institutional and high-net-worth capital for value-add and opportunistic investments. Over the past decade, Private equity real estate - REPE funds have targeted high-return projects like distressed office conversions or multifamily redevelopments. REPE funds focus on sectors with structural tailwinds. Currently logistics, multifamily, data centers are examples. REPE funds are pivoting to niche sectors such as senior housing, biotech, and specialty life sciences.

Sovereign Wealth Funds – SWF have also become major real estate players, seeking stable, long-term returns. Funds like Norway’s Government Pension Fund Global or Saudi Arabia’s Public Investment Fund have invested heavily in trophy assets such as London financial district offices and logistics hubs in the United States. SWF’s have provided deep capital for mega-projects like Hudson Yards in New York City and helped absorb distress during downturns such as post-pandemic retail.

The Next Wave + Democratization of Real Estate Investment

Historically, real estate investment required significant capital, limiting participation to institutions or wealthy individuals. Post-2008 regulatory reforms and technology are broadening access, particularly for commercial real estate - CRE. Fractional Ownership Platforms like Fundrise, RealtyMogul, and Cadre allow investors to buy fractional shares in CRE office buildings and multifamily with as little as $500. These platforms have raised billions, enabling retail investors to access institutional-grade assets. These platforms offer curated deals, financial transparency, and automated reinvestment. Some integrate filters to focus on niche sectors like healthcare or logistics.

Blockchain-based tokenization converts real estate assets into digital tokens, tradable on secondary markets. Examples include tokenized stakes in a Miami condo or a Zurich office building. Although in development, global tokenized real estate market size is projected to hit $10 billion by 2030. This market enhances liquidity, lowers entry barriers, and enables global investment. Smart contracts ensure transparency and automate payouts, but they currently lack scale and broad adoption.

Platforms like CrowdStreet and PeerStreet enable accredited investors to pool funds for specific projects like a single property hotel redevelopment. These platforms offer higher potential returns but with greater risk. They are increasingly integrating AI for deal screening and risk modeling, appealing to early career investors seeking diversification beyond equity markets.

Why Specialty Trade Contractors Should Pay Attention

The financialization and democratization of real estate financing are reshaping the commercial real estate (CRE) landscape, with profound implications for Starnet members and other construction professionals. Projects are becoming more diverse, complex, and fast-paced. For architects, designers, general contractors, and specialty trade contractors, this evolution demands agility and foresight.

The rise of non-bank financing and platforms fuels niche projects in high-growth sectors which may challenge norms around products and processes used. Understanding which asset classes attract capital helps contractors align their services with funded projects. Many of our members remember their first student housing project at a captured University account. The learning curve was steep, but worth it to prevent a competitive company from accessing the campus or general contractor decision makers.

Alternative lenders and tokenized platforms prioritize speed and efficiency, often accelerating project timelines. Contractors adapting to tighter schedules, leveraging technology to streamline bidding, non-traditional material performance sourcing, and boldly innovative installation processes.

As financing democratizes, more developers will enter the market, driving demand for high-quality, bespoke work. Flooring contractors who invest in innovative materials, standard operating practices, and compliance certifications can position themselves in competitive bids with data, especially for private equity or REIT-funded projects. The integration of AI, blockchain, and data analytics in financing and project management offers contractors tools to optimize operations and set the pace for the industry.

Specialty trade contractors can vet project owners’ financial stability and prioritize contracts with well-funded developers, such as those backed by sovereign wealth funds or established REITs.

Commercial flooring contractors must stay informed about financing trends and their ripple effects on project pipelines. These trends will impact their end users, general contractors, architects and designers directly. Aligning with emerging sectors, embracing technology, and building relationships with work pipelines supported by choice capital sources, such as private equity firms or crowdfunding platforms, is a legitimate strategy.

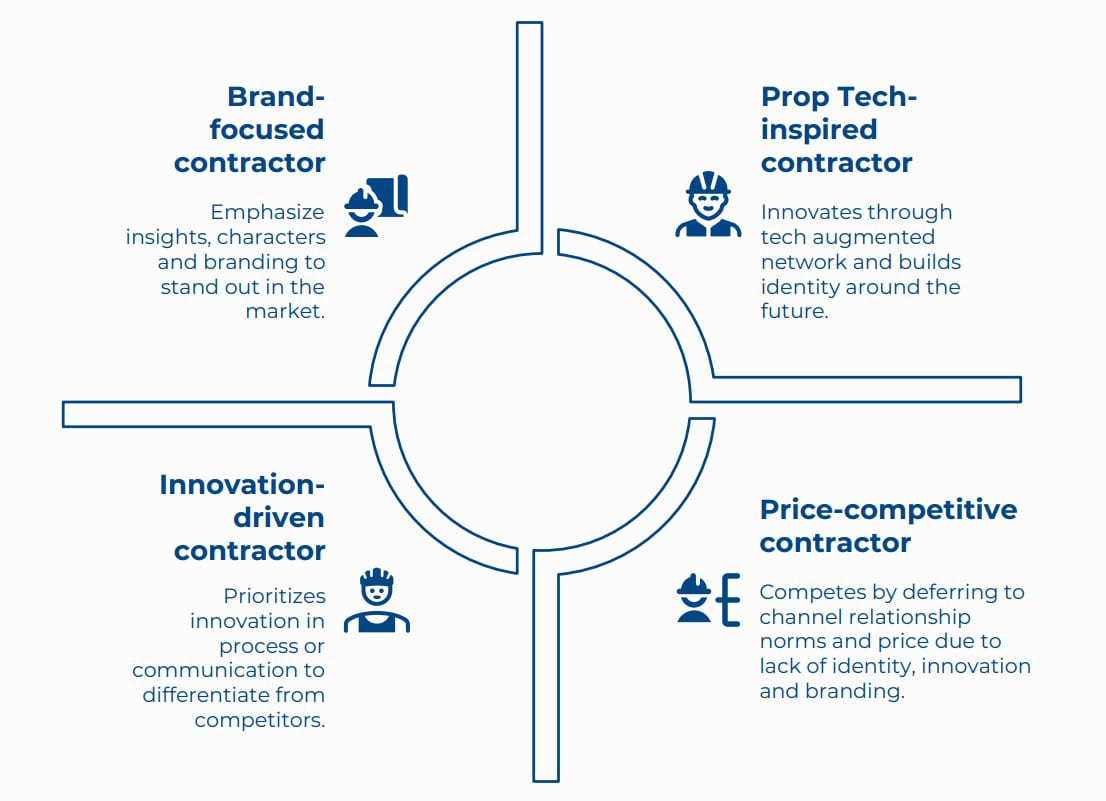

Starnet contractors can position themselves as indispensable partners to these audiences and choose to win. By understanding these trends, contractors can strategically position themselves to win contracts, mitigate risks, and leverage technology to meet the demands of a dynamic market, ensuring long-term growth and relevance.